Written By: Vishesh Kumar

Where has the pricing strategy model gone wrong and how to fix it?

How much to charge for my product or service? What is going to be my strategy of pricing? Those are key questions staring at senior executives responsible for making decisions around the pricing model at any enterprise. In theory, the price of a product or service is determined by the quantity of an offering that a producer desires to sell at various prices and the quantity consumers desire to buy (the age-old “law of supply and demand”). In the real world, enterprises set prices for goods based on cost, demand, competition, customer benefits, or a mix and match of these factors. Setting prices below, at the same level, or above the competition is a pretty straightforward approach. It is easy to implement and does not require extensive research or analysis. Adding a percentage markup to the cost of production is another method that is easily implementable. Data science has stepped up to support the pricing strategy model in more ways than one.

Large-scale analysis of historical data is key to uncovering trends, patterns, and relationships relevant to price setting. Adjusting prices on the fly based on demand, stocks, and other factors (“dynamic pricing”) is also a popular approach. Nearly a third of all retailers in the UK and Europe now engage in dynamic pricing with a view to optimizing revenue. Cutting-edge technologies like AI and price optimization software ensure the rollout of the dynamic pricing model at lightning speed and with high precision. The returns from this exercise are most conspicuous in segments like entertainment, home maintenance supplies, hygiene products, grocery, home electronics, DIY, and sports equipment.

Importance of the Pricing Strategy Model

Have a look at the competitor’s pricing strategy model

Businesses look to win over more customers and proactively build market share by setting a lower price than the competition for the same kind of product or service. Alternatively, a business could go for a price that is at par with the competition. Yet another pricing strategy model involves cranking up the price a notch or two above the competitor’s, hoping to create a perception of higher quality around the product. Competition-based pricing is much less taxing than other pricing models and is essentially about monitoring peers’ price points and feeding these into the company’s pricing mechanism. So, practitioners love this pricing model, and it seems to work most of the time. But there are some downsides though. For instance, sub-optimally setting prices based on what the competitor is charging might trigger a self-destructive and aggressive price war.

Base pricing on the unit cost of production

Top up the unit cost of a product with a fixed percentage to arrive at the selling price of the offering. That’s cost-plus pricing in the fewest possible words. The idea at the heart of this pricing strategy model is to justify price hikes using increases in cost inputs (labor, materials, running expenses) as a baseline. It’s as simple as that. However, the weak spot of this otherwise good-enough pricing approach is that external factors (most importantly, competitor pricing) don’t enter the equation at all!

Consider the mélange of complex factors that impact prices

Dynamic pricing (aka surge pricing, demand pricing) is another pricing strategy model that is seeing growing popularity. This real-time price-setting method is premised on the fact that consumers are ready to dish out different sums for the same product or service depending on the time (peak time v. lean time), urgency of their need, and stock availability. Other factors include how well the offer price corresponds to the consumer’s perception of affordability and fair price. Online retail giant Amazon dynamically reprices inventory running into millions as frequently as every 2 minutes (!), depending on the competitiveness of the product. The repricing software responsible for this feat applies artificial intelligence and machine learning to arrive at optimal price points, and these help sellers make the most profits, but without precipitating a price war.

How can Infiniti Research help you with its solutions?

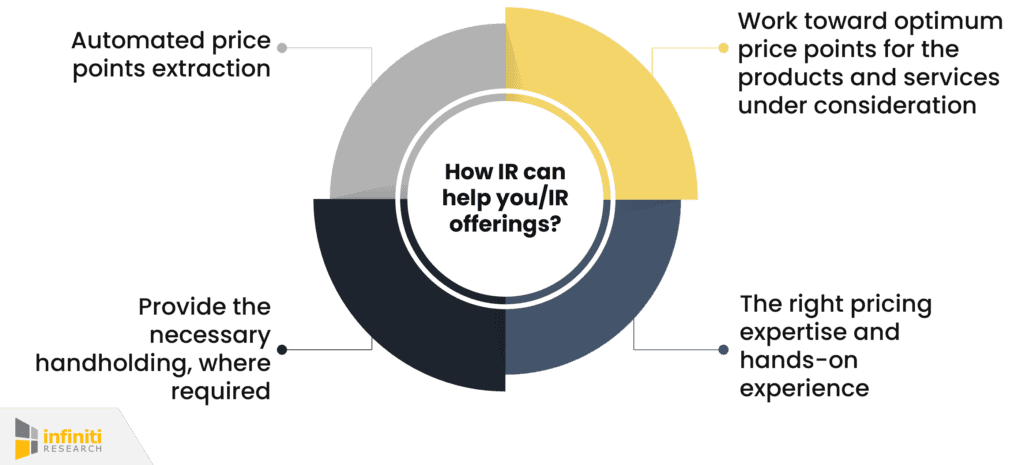

At Infiniti Research, our pricing strategy consultants leverage advanced data gathering techniques and multi-pronged approaches to pricing research. Our studies include automated price points extraction as well as surveys of key decision-makers and influencers responsible for evaluating and implementing clients’ products and services. This helps us understand the potential benefits that flow to end users, which is a key determinant of product pricing. We then work toward optimum price points for the products and services under consideration and, furthermore, trace how the pricing model will impact buyer behavior, revenues, and profits. Different price points, with differing benefits, are showcased to the client. Furthermore, our pricing experts provide the necessary handholding, where required, so the client can pick the most optimal pricing recommendation. In a nutshell, we have the right pricing expertise and hands-on experience with the real-world pricing strategy model to support your needs.

To know how Infiniti Research can help you with your business requirements;

Success Story, how we helped our client

Summary of Case Study:

A reputed sports goods brand keeps a close eye on competitors’ pricing strategy model to improve margins. As always, our home-grown AI framework (“DART”) for heavy-duty online data harvesting did the trick. So, trial and error approaches in pricing go out the window. A fact-based approach to pricing is the whole new flavor, and many forward-looking businesses are well on to that. Our pricing model consultants can collaborate with your teams to optimize your price points and get you more profits. Talk to our experts now.

A well-framed pricing strategy model – centered on the DART platform, yields dividends for a sports goods manufacturer

Our client is a well-known sports goods manufacturer boasting a distinctive line of sports equipment, protective gear, and various accessories. Over the last five decades, the client has made a mark with outstanding product quality, consistent innovation, and by putting sustainability at the heart of all it does. The client’s annual revenue crossed the set targets in 2022 and has posted a CAGR of 10-11% in the last five years and the leadership expects to sustain this trend in the near-to long term.

Sports equipment and accessories is a segment where competition for market share has intensified lately. Price points are particularly important to expanding the company’s share of market sales. So, it’s no small wonder that the client is considering competitive pricing as a key growth lever in the days ahead. The client’s marketing organization has already invested considerable time and effort to identify the strengths and weaknesses of the competitors’ pricing model. With a view to up this game, the client’s teams looked for real-time updates on competitor prices. By early 2022, the client decided to draw on the expertise of our market intelligence teams. In fall 2022, the client mandated our team to work on a thoroughgoing price analysis of competitors to help the client respond to rapid price changes in real time. By so doing, the client hoped to secure and grow market share determinedly.

Our experts undertook an in-depth and comprehensive analysis of competitors’ pricing strategy to gain a better understanding of their strengths and shortcomings. Our teams employed an entire repertoire of tools, including price tracking platforms, customer surveys, and market intelligence. But the central piece was DART, our home-grown AI platform for heavy-duty online data gathering and insights generation. By continuously monitoring price movements of competitor products over a predefined period, we were able to pinpoint opportunities for the client to employ price as a key differential. Our DART framework enabled the client to obtain granular and actionable data on competitor prices at a country and brand level, updated on a daily basis.

The client is factoring in the insights pulled in by DART to recalibrate price points for key product categories. Thanks to our pricing strategy model and DART-driven competitor intelligence, the client is now able to make dynamic changes to the pricing of thousands of SKUs – every single day! More importantly, our pricing model has armed the client’s teams with the real-time data they need to respond to the competitor’s pricing moves. Previously, the client’s teams would work out the desired price points through trial and error. This resource-wasting approach of learning from mistakes is now a thing of the past!

To get a preview of our solutions,