Exploring the relationship: Financial services and customer intelligence platforms

Without a clear and complete idea of their customers’ expectations, likes, dislikes, motivations, and needs, financial services will struggle to deliver the right products to customers and navigate various challenges in their landscape. Traditional financial services (banks, advisories, wealth management firms, mutual funds, insurers, all included) risk disruption by nimble-footed and digital native fintechs while the rising cost of regulatory compliance is straining their budgets to no end. Moreover, extracting relevant and actionable information on the market from the mountains of data they generate is no easy task for these organizations. In order to continue providing targeted financial services to the most likely buyers, financial services must put data into specific customer contexts.

Customer intelligence platforms are software expressly built to help businesses, including financial services, aggregate data from multiple sources. Further, these tools make use of AI and machine learning to discover the direction in which customer behavior is heading and the underlying rationale. The C-suite at financial services can use these and more customer insights to make well-thought-out decisions to drive better relationships and positive experiences with the customer base, leading to increased repeat purchases and uptake in revenue.

Importance of the customer intelligence platforms

Unlock growth with product innovation

As discussed, with customer intelligence platforms in place, financial services will get a mega push in multiple areas such as highly innovative and exceptional personalized experiences for customers. Besides, financial services can cash in on company-generated insights unlike at any time in the past. Of course, sculpting newer and more revenue streams is the other objective. Customer intelligence platforms bring into play powerful machine-learning models capable of learning and drawing meaningful inferences from customer data. The result is a more methodical approach to dividing up the customer base into groups based on buying patterns and a better understanding of what customers think of, say, a bank or its products. Offering innovative products and personalized services based on customer preferences is the logical next step.

Monetize customer data faster

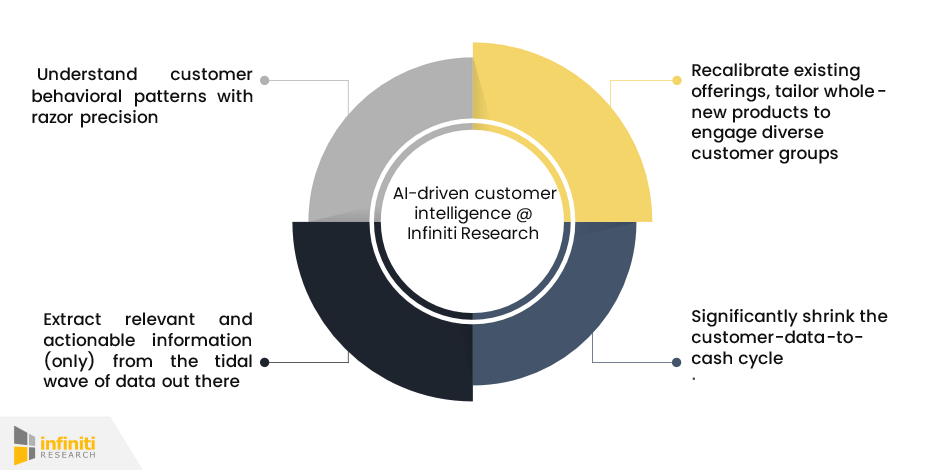

By harnessing AI and ML technologies to great effect, customer intelligence platforms crunch customer data of epic proportions to force out relevant insights.

Thus, financial services can ‘tiptoe’ through the mind space of customers, both existing and potential. They can size up their unmet product needs, what they feel about the business, and things they are upset or annoyed about. This deep, accurate, and timely understanding of the customer psyche serves as a true baseline for crafting experiences that reverberate better with the customer base. This sculpts deeper customer associations with the brand and opens new growth windows for the business. So, in a way, customer intelligence platforms help shrink the customer-data-to-cash cycle for financial enterprises, so to speak.

Profit!

In the fewest possible words, customer intelligence platforms provide the booster shot financial services badly need to realize more profits in volatile markets and challenging times like these times. They trigger a chain of positive tipping points for financial services, from customer insights generation, personalized product development, and customer loyalty, all the way to margin expansions. Overall, customer intelligence platforms will enable financial services to firm up their competitive edge in the market and ensure sustained success over time.

How Infiniti Research can help you?

It takes a razor-sharp understanding of the behavioral patterns of your target audience to develop customer-centric business strategies. That could spell all the differences between success and failure! Account intelligence-based win-loss assessments, for instance, enable businesses to evaluate with high precision the underlying dynamic responsible for the success or failure of sales opportunities.

At Infiniti Research, our experts, with more than two decades of direct experience, including in customer intelligence, offer a wide range of research and analytics services to help businesses hit the bullseye in customer marketing for the best results. Our services include:

- Buying behavior analysis

- Brand awareness

- Vendor perception

- Customer satisfaction survey

- Customer discovery and targeting

- Concept testing (e.g., interest level, willingness to pay)

- Product preferences / concerns

- Voice of the customer

- Customer persona development

- Customer reviews

- Customer ratings

A global fashion retailer finds customer intimacy at scale with Infiniti Research

Online marketplaces continue to drive growth for fashion retailers worldwide by enabling them to tap a broader customer base. Sustainability is emerging as a key mantra for the sector as customers increasingly hanker after eco-friendly materials and ethical sourcing practices. Our client is a fashion retailer present in 50+ locations globally and the business is focused on improving sales on a continuous basis. More recently the client has pivoted to omnichannel commerce like many of its peers with the idea of delivering frictionless customer experiences across online and offline stores (“omnichannel commerce”). However, despite this and a few other sales restructuring efforts, footfalls are still below expectations in the client’s brick and mortar stores. The client realized that decoding customer data held the key to scripting more effective and personalized customer experiences and generating appreciable revenue.

In early 2022, after examining various in-market customer intelligence platforms and solutions, the client decided to settle for our solution based on the testimonials of other clients. The overall positive brand perception also swayed our solution in the client’s favor. Our experts in customer intelligence soon began to work with the client teams to identify shortfalls in their customer engagement strategy and fashion new ways to enhance margins. Our experts helped the client develop a “single pane of glass,” unifying customer purchase history, feedback, and preferences derived from multiple touchpoints. With this, the client was able to gain a single view of customers, a pain point the business had been struggling with for quite a while. Our team proceeded to figure out the issues customers face in both online and offline purchase, and suggested ways to sweeten the client’s merchandise to suit a multiplicity of palates. Furthermore, our team assisted the client teams to leverage cutting-edge forecasting models to adjust inventory levels, based on historical and real-time market trends. This has minimized instances of “no stock” and “overstock” scenarios, both of which drain brand value and customer trust significantly.

Conclusion

Our client is a fashion retailer present in 50+ locations globally and the business is focused on improving sales on a continuous basis. More recently, the client has pivoted to omnichannel commerce. However, despite this and a few other sales restructuring efforts, footfalls are still below expectations in the client’s brick and mortar stores. Our experts in customer intelligence helped the client develop a “single pane of glass,” unifying customer data from across multiple touchpoints. Ever since the client has been able to gain a single view of customers, a pain point the business has been struggling with for quite a while. Our team proceeded to sweeten the deal around the client’s merchandise to win over diverse customer groups and this is showing good results.